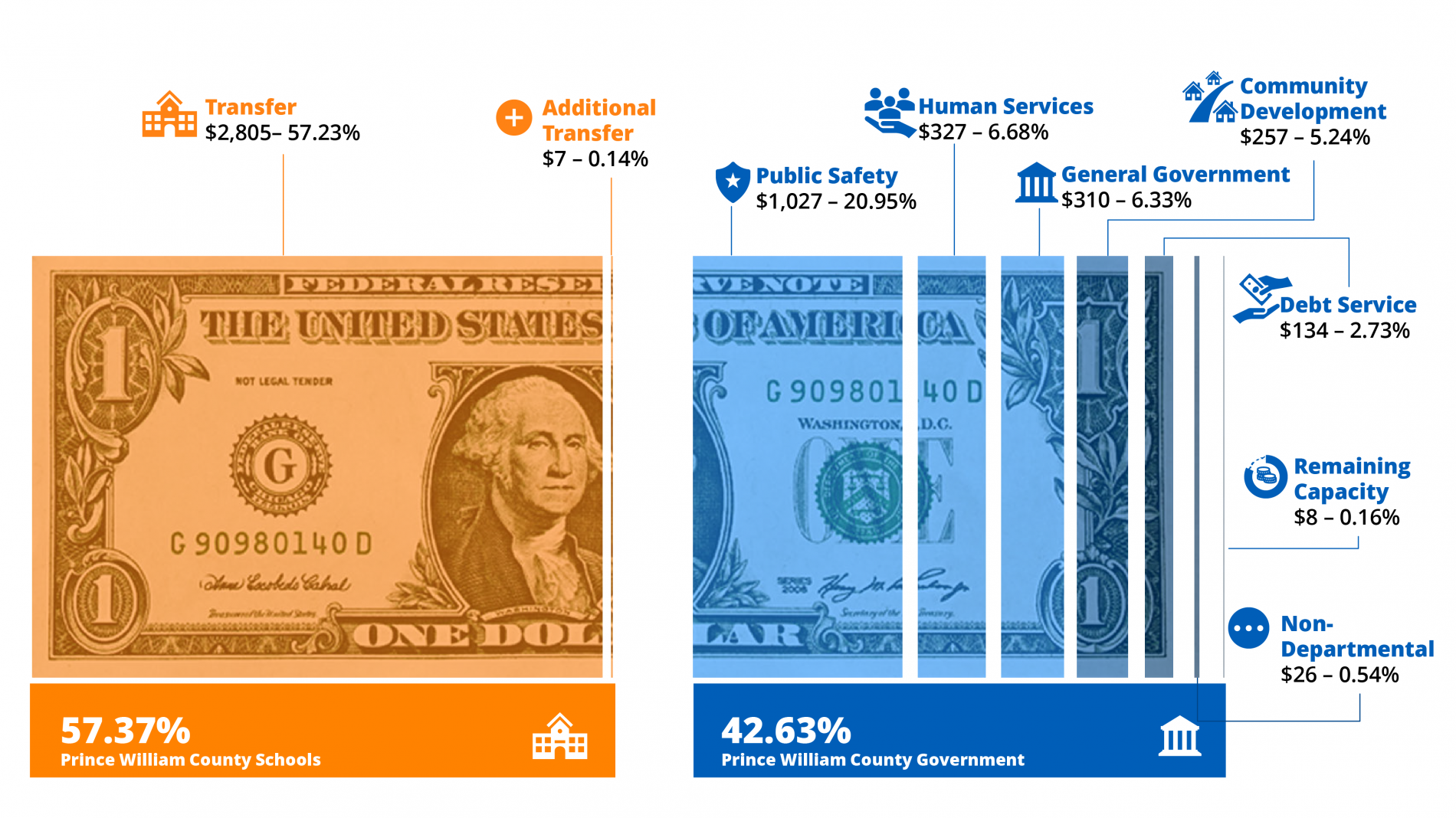

prince william county real estate tax payments

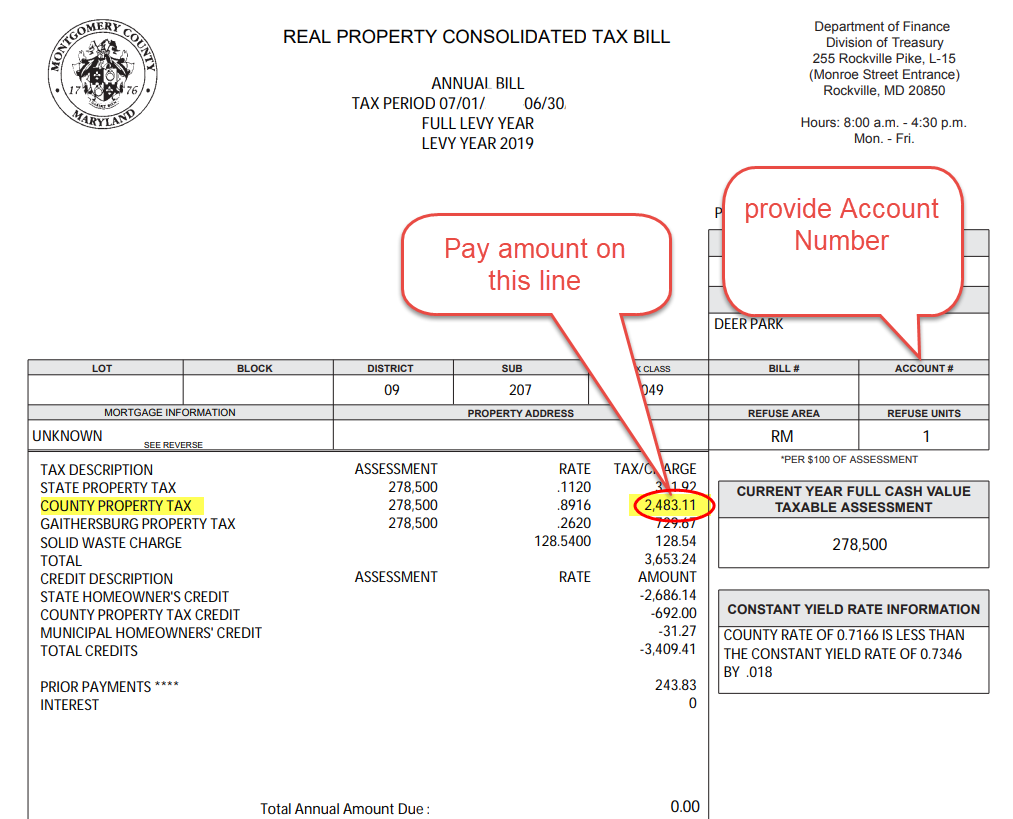

When tax assessors estimate the value of your property they multiply that number by the tax rate of the county. In Prince Georges County you can pay your property taxes in a few different ways.

Press 1 for Personal Property Tax.

. Prince William County real estate taxes for the first half of 2022 are due on July 15 2022. Provided by Prince William County Communications Office. Proceso de pago en espanol.

When prompted enter Jurisdiction Code 1036 for Prince William County. Finding the Amount of Property Taxes Paid. By creating an account you will have access to balance and account information notifications etc.

In Prince William County. You can pay a bill without logging in using this screen. 1-888-272-9829 enter code 1036.

Manage Access - Grant Revoke. The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700. Access to Other Accounts.

Correspondence and Tax Payments. Enter the Tax Account numbers listed on the billing. Contact the Real Estate Assessments Office Available M.

Prince William County Tax Administration Division PO Box 2467 Woodbridge VA 22195-2467. Prince William County is located on the Potomac River in the Commonwealth of Virginia in the United States. Whether you are already a resident or just considering moving to Prince William County to live or invest in real estate estimate local.

Occasionally the billing information on file is incorrect and a real estate tax bill that should have been sent to a. Click here pay online. Prince William County collects on average 09 of a propertys.

Payment of the Personal. Learn all about Prince William County real estate tax. A convenience fee is added to payments by credit or debit card.

Property taxes in Prince William County are due on. The Department of Tax Administration is responsible for uniformly assessing and billing personal property taxes business license tax business tangible tax Machinery and Tools Transient. Press 2 for Real Estate Tax.

Those who waited until the last minute to pay their personal property taxes in Prince William County encountered problems. How The Payment Process. This estimation determines how much youll pay.

You can pay online by mail or in person. There are several convenient ways to. Search 703 792-6000 TTY.

Prince William County real estate taxes for the first half of 2020 are due on July 15 2020. Welcome to Prince William Countys Taxpayer Portal. The County bills and collects tax payments directly from these companies.

The Prince William County Department of Finance reminds residents that personal property taxes are due on or before Monday Oct. At 930 pm the county announced its online. July 2 2022.

All you need is your tax account number and your checkbook or credit card. The Department of Tax Administration is responsible for uniformly assessing and billing personal property taxes business license tax business tangible tax Machinery and Tools Transient. Payment by e-check is a free service.

There are several convenient ways property owners may make payments. Teléfono 1-800-487-4567 entrando código 1036.

Prince William County Real Estate Taxes Due July 15 2022 Prince William Living

Less Taxes Less Spending Prince William Residents Decry Proposed Hike In Tax Bills Headlines Insidenova Com

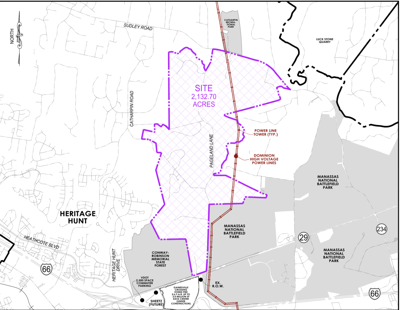

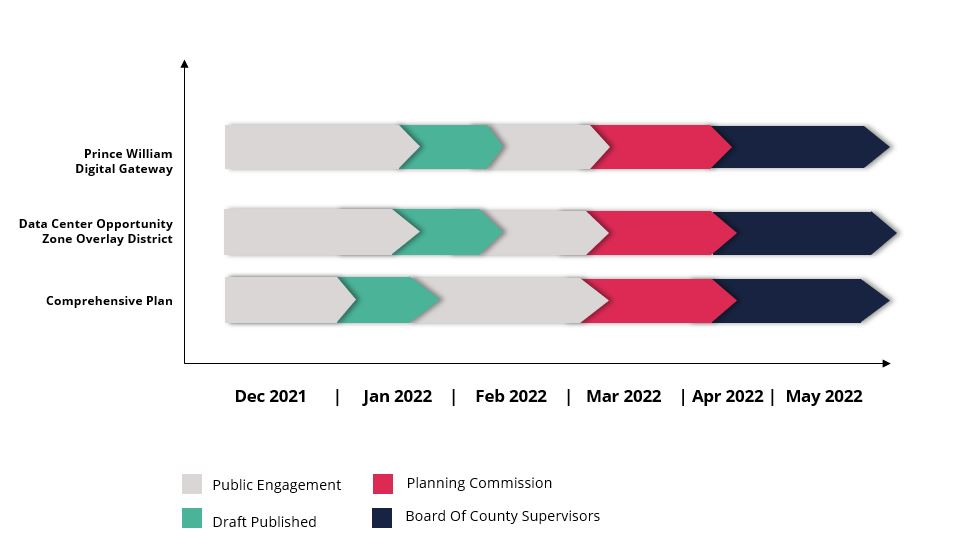

Prince William County Board Schedules Final Public Hearing On Pw Digital Gateway Headlines Insidenova Com

Prince William County Va Businesses For Sale Bizbuysell

The Sheriff Of Nottingham In Prince William County

Prince William County Virginia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Prince William County Leaders Propose 4 Meals Tax Beginning July 1 News Princewilliamtimes Com

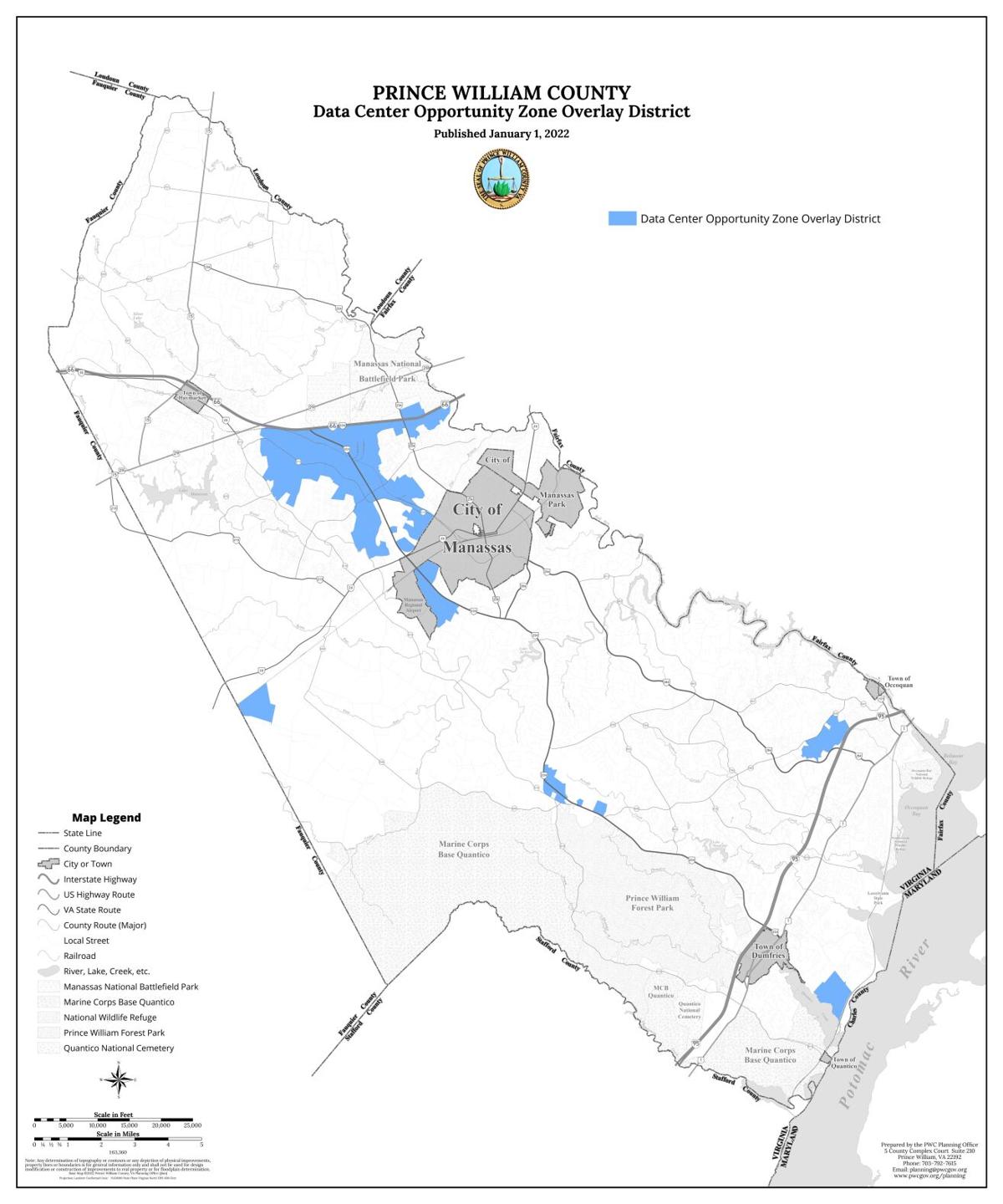

Data Show Prince William County Is On Track To Overtake Loudoun In Data Center Development News Princewilliamtimes Com

Data Center Protest Planned At Government Center Ahead Of 2 Key Votes

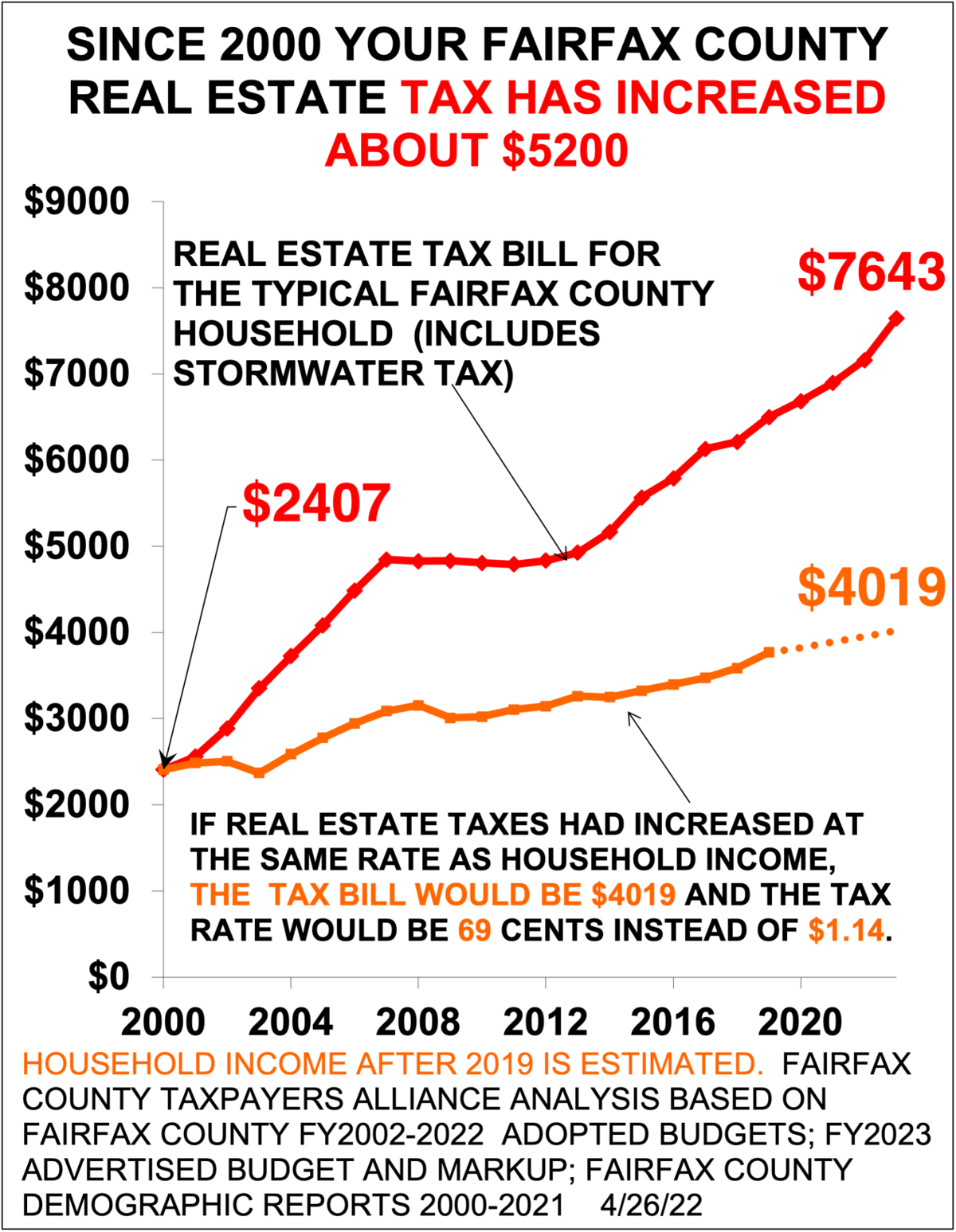

Fairfax County Homeowners To Get A 600 8 Tax Hike Opinions Fairfaxtimes Com

Qts Prince William Landowners Propose Massive Data Center Campus Washington Business Journal

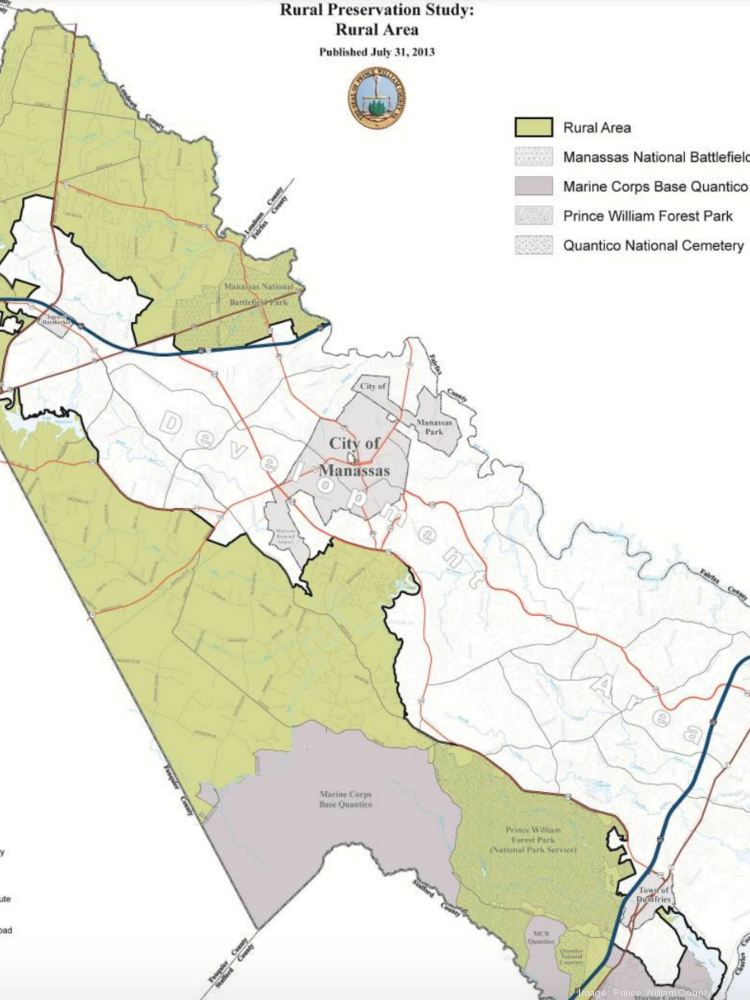

Prince William County Considers Land Use Changes That Encourage Sprawl The Piedmont Environmental Council